Deciphering the Dilemma: When is the Best Time to Invest in Stocks?

Updated Oct 7, 2024

Introduction

Investing in stocks has been fascinating and studied for centuries, with experts from various eras contributing their insights to this complex field. In this updated essay, we’ll explore the timeless wisdom of when to invest in stocks, incorporating views from renowned experts spanning from the 13th century to the present day.

The Contrarian Approach: A Time-Tested Strategy

The essence of successful stock investing often lies in adopting a contrarian approach. As the legendary investor Warren Buffett famously stated, “Be fearful when others are greedy, and greedy when others are fearful”. This principle encapsulates the core of contrarian investing, suggesting that the best time to invest is often when the masses are gripped by fear and uncertainty.

Historical Perspectives on Market Psychology

Studying market psychology and its impact on stock prices is not a modern phenomenon. As far back as the 13th century, Italian mathematician Fibonacci observed patterns in nature that would later be applied to financial markets, suggesting that human behaviour in markets follows predictable cycles.

Fast-forward to the 20th century, and we find Benjamin Graham, often referred to as the father of value investing, emphasizing the importance of looking beyond market sentiment. Graham’s approach, which influenced many modern investors, including Warren Buffett, focused on identifying undervalued companies when the market was overly pessimistic.

The Cycle of Emotion in Modern Markets

In today’s fast-paced financial world, understanding the cycle of emotion in markets remains crucial. As Mary Childs explains in her book “The Bond King,” even sophisticated investors like Bill Gross have had to navigate the complex interplay between market sentiment and fundamental value. This underscores the enduring relevance of contrarian thinking in modern investing.

The Power of Patience and Discipline

Successful investing requires not just contrarian thinking but also patience and discipline. John Bogle, founder of Vanguard, wisely advised, “Don’t look for the needle in the haystack. Just buy the haystack!”. This approach advocates for a long-term, diversified investment strategy rather than trying to time the market perfectly.

Adapting to Changing Market Dynamics

While the fundamental principles of contrarian investing remain valid, adapting to changing market dynamics is important. Artificial intelligence and strong corporate earnings have driven significant market movements in recent years. Investors must balance timeless wisdom with understanding these new forces shaping the market.

Now, let’s scrutinize the situation through the lens of history, as those who neglect to learn from the past are destined to endure its harsh lessons again.

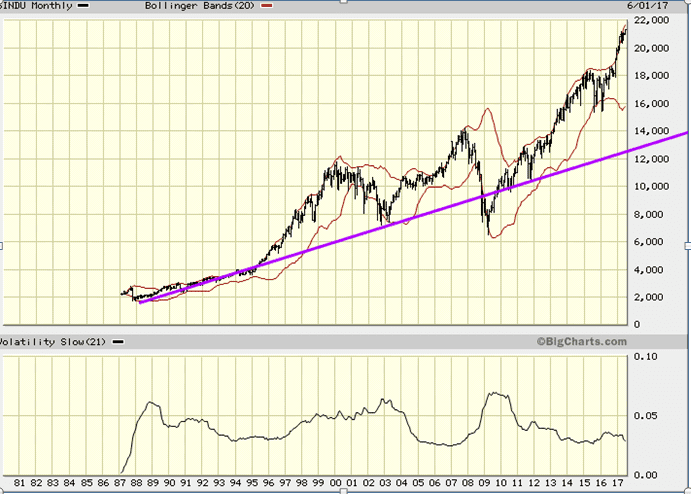

Let’s start with a bit of history. The chart below illustrates quite clearly when astute investors begin to buy stocks.

If you purchased stocks between Sept 2008 and March 2009, you would be sitting on a fortune today. If one had repurchased in Sept of 2008, one would have had to deal with significant volatility. However, the astute investor always deploys capital in equal lots and never deploys it in one shot.

Take a look at the chart below.

Timing the Market: Unveiling the Optimal Moment for Stock Investments:

Amidst all the chatter surrounding the 1987 crash, it is often overlooked that it presented one of the most exceptional buying opportunities ever. When markets experience a sharp pullback or crash, fear and panic can lead investors to hastily sell off even high-quality stocks at rock-bottom prices. However, for those who remain level-headed and astute, this can be a once-in-a-lifetime opportunity to buy into the market. Of course, it’s not always easy to take advantage of such opportunities, as, at the moment, it can feel like the market will never recover. Let the market come to you; never chase it.

COVID Crisis: Another Stupendous Opportunity.

Undoubtedly, we are experiencing one of the most challenging times since the financial crisis in 2008, and many are wondering when the best time to invest in stocks is.

Hysteria has gripped everyone, especially in the U.S., and it’s feeding on itself as everyone from the top of the rung to the bottom is running around like headless chickens. Before we continue, we will not distort the truth or makeup stories; in the short term, we have taken a beating, and it’s a bloodbath out there.

After witnessing several crashes, we have never seen such a situation, which presents an opportunity for investors. Everyone at the Tactical Investor is freeing up all the available cash they can, and when the panic subsides, it will create a feeding frenzy like we have never seen before.

When you combine zero rates, two trillion dollar injections by the Feds, and several more billion-dollar packages designed to stimulate the economy, the result will be a market melting upwards. The markets will be driven to unimaginable heights by today’s standards, and those who invest wisely will reap the benefits. Zero rates will also force many individuals on a fixed income to speculate, and these guys have a lot of cash sitting on the sidelines.

Buy when the insiders are loading up.

The best answer to this question is: When is the best time to invest in stocks? It is when the insiders buy hand over fist.

The chart above speaks for itself – insider buying has historically been a strong indicator of long-term stock performance. Currently, the sell-to-buy ratio is at a low not seen in a while, indicating that insiders are not just buying shares but devouring them. While insiders may be unable to time the absolute bottom of a market downturn, their purchases reflect their confidence in a company’s long-term outlook.

Looking back at the financial crisis of 2008, we see a similar pattern of insider buying. In October 2008 and again in 2009, insider buying spiked just before the market bottomed in March 2009. This led to an 11-year bull run with some bumps along the way, but overall, insiders who bought during the crisis reaped significant profits.

Although the short-term outlook may be unpredictable due to current market hysteria, historical data spanning over a century indicates a bullish outcome in the long term. As Winston Churchill famously said, “Never waste a good crisis.” During times of crisis, top-notch stocks can be purchased at a discount, offering the potential for spectacular gains.

Sir John Templeton to the Rescue

To buy when others are despondently selling and to sell when others are euphorically buying takes the greatest courage, but provides the greatest profit. Bull markets are born in pessimism, grow on scepticism, mature on optimism and die on euphoria. The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell. If you want to have a better performance than the crowd, you must do things differently from the crowd.

The current readings indicate that insiders are not just buying shares. Still, they are devouring them, as shown by Vickers’ benchmark NYSE/ASE One-Week Sell/Buy Ratio of 0.33 and the Total one-week reading of 0.35, based on very heavy transaction volume. This behaviour is similar to what we observed in late December 2018, early 2016, and late 2008/early 2009, which were all spectacular times to buy stocks. The insiders’ actions seem to be sending a clear message that the current situation offers a similar opportunity for investors.. https://yhoo.it/2TV0cE2

According To The Naysayers: It’s always raining.

The naysayers can talk all they want about supply lines being backed up for months or other scenarios that they pull out of their rears. However, the best time to invest in stocks is when the markets discount all the bad news. Furthermore, these experts are severely downplaying the role of technology. Suddenly, many businesses will see that many personnel can be replaced with AI-based technology without interrupting the flow of goods. Replacing them will improve efficiency on a colossal scale.

Once the markets discount all the bad news, this massive mountain of money will flood the system, making the Bull Run from 2009 look like Child’s Play. The amount of money the Fed has already thrown into this market makes 2008 look like a stroll in the park. Officially, we think they will throw north of $5 trillion; unofficially, the figure could end up being north of $10 trillion.

Neel Kashkari, president of the Federal Reserve Bank of Minneapolis, said Sunday night on CBS’s “60 Minutes” that “there is an infinite amount of cash in the Federal Reserve. We will do whatever we need to do to make sure there’s enough cash in the banking system.” And there you have it, a tacit acknowledgement that forever Q.E. is real and here to stay. When the Fed states it will do whatever it takes, you better believe this statement.

Don’t Fight the Fed: Regardless of the expert’s opinion, you should never fight the Fed, for you will end up dead—dead as in dead broke.

Conclusion

In conclusion, the best time to invest in stocks often aligns with periods of market fear and uncertainty. However, successful investing requires more than just contrarian thinking. It demands a combination of historical perspective, understanding of market psychology, patience, and adaptability to changing market conditions.

As we navigate the complex world of stock investing in 2024 and beyond, the insights of experts from Fibonacci to Buffett continue to provide valuable guidance. By combining these timeless principles with an understanding of modern market dynamics, investors can position themselves for long-term success in the ever-evolving world of stock markets.

Exceptional Discoveries Await Your Curiosity